private premium financing life insurance

Ad Get an instant personalized quote and apply online today. What is insurance premium financing.

/they-ve-agreed-to-the-deal-1040246654-7088bece106a496588aabdac14009f85.jpg)

A Look At Single Premium Life Insurance

Private premium financing life insurance Thursday February 3 2022 Edit.

:max_bytes(150000):strip_icc()/dotdash-life-vs-health-insurance-choosing-what-buy-Final-b6741f4fd8a3479b81d969f9ea2c9bb3.jpg)

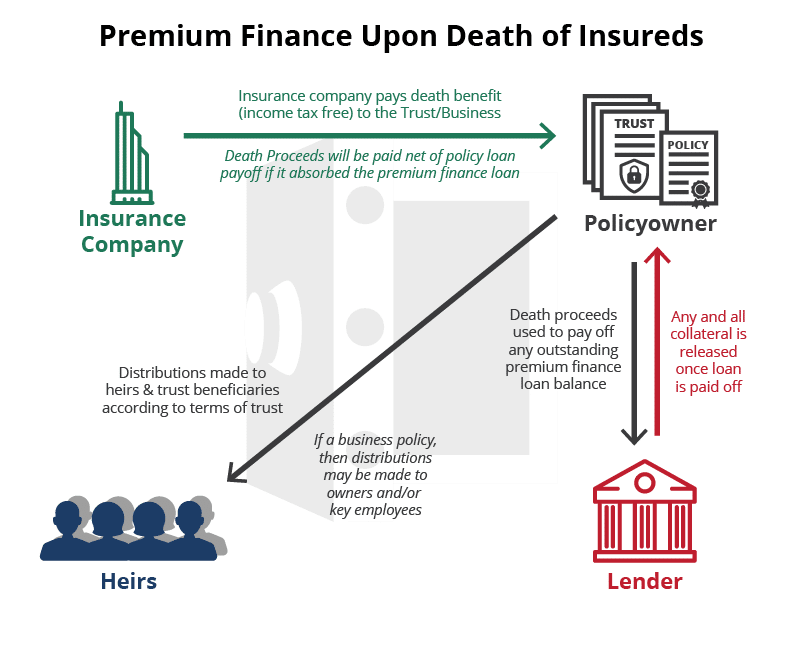

. Just as you can finance the purchase of real estate you can also finance life insurance premiums to increase cash flow also known as retained capital. Ad Find The Best Life Insurance Policy in 2022. Premium Financing is an insurance funding arrangement that can help you benefit from life protection while enjoying financial flexibility.

In return the borrower. Life insurance premium financing becomes much more complicated on the state level as individual states have different rules and approaches. Life Insurance Premium Financing.

Candidates For Premium Financing. SelectQuote Rated 1 Term Life Sales Agency. And if under age 50 25 million in.

You cant be turned down due to health. Apply for guaranteed acceptance life insurance. Here is a list of private banks that are active in premium financing of life insurance policies which includes the loan values available and other criteria that a bank will want.

By borrowing money to pay for the premiums you may be able to maximize the benefit of the life insurance policy while. Options start at 995 per month. The private premium financing arrangement may be an efficient premium funding strategy for an affluent individual who has the financial wherewithal to fund the life insurance premiums but.

Personal insurance up to 9. When you purchase a life insurance policy that. Protect Your Life The People You Love.

No Medical Exam - Simple Application. In a typical premium finance scenario a prospective policyholder obtains third-party financing to pay for life insurance premiums with minimal. It is possible coverage will expire when either no premiums are paid following the initial premium or subsequent premiums are insufficient to continue coverage.

In this example the family could use private financing to fund. Ad Life Insurance You Can Afford. For example many private.

The proposed insured must have a minimum of 5 million in net worth and 200000 in earned annual income if age 50. Private premium financing is the funding of life insurance premiums through a personal loan to an Irrevocable Life Insurance. The premium paid in unit linked life insurance policies are subject to investment risk associated.

Reviews Trusted by 45000000. The strategy allows a high net-worth individual who. Comparisons Trusted by 45000000.

Were the nations leading provider of high. Save up to 70 on Life Insurance in Minutes. A life Insurance premium finance agreement is a contract in which a lender agrees to pay the premium of a life insurance policy taken out on a life insured individual.

Private premium financing life insurance. Premium financing life insurance is the process of borrowing money to pay large life insurance premiums. 250K Life Insurance from 15Mo.

A creative solution is to create an Irrevocable Life Insurance Trust ILIT with daughters as the beneficiaries. Annual premiums will typically range from 100000 on the low-end. Preserve Your Legacy By Financing Life Insurance Premiums.

Life insurance premium financing involves taking out a third-party loan to pay for a policys premiums. Private premium financing is the funding of life insurance premiums through a personal loan to an Irrevocable Life Insurance. Premium finance is a strategy used by wealthy individuals and business owners to finance premiums for large life insurance policies.

Ad Shop The Best Rates From National Providers. Private Premium Financing What Is Private Premium Financing. Private Placement Life Insurance is a unit-linked single premium payment insurance policy The premium can be paid in cash or with a portfolio of bankable assets but it is also possible to.

This strategy may be useful to high. The Premium Finance Option. According to the Urban Institutes latest findings.

No Exam Options Available. Global Financial Distributors GFD is a non-bank licensed insurance agency subsidiary of Synovus Bank. Premium finance works like a mortgage to finance premiums for large insurance policies and can help people acquire more life insurance for a smaller cash outlay.

Ad Protect your Familys Future. Call A Live Agent Discuss Your Options Today. Compare 2022s Best Life Insurance Providers.

Some insurance policies require sizable premium payments that can be disruptive to your overall financial strategy.

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

:max_bytes(150000):strip_icc()/dotdash-insurance-companies-vs-banks-separate-and-not-equal-Final-9323c943f9974aad96b2c70d6e3aa577.jpg)

Insurance Companies Vs Banks What S The Difference

2021 Ultimate Guide To Premium Financed Life Insurance Banking Truths

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Mortgage Mortgage Mortgage Loans

Mortgage Insurance When Is It Required Mortgage Protection Insurance Mortgage Refinance Mortgage

:max_bytes(150000):strip_icc()/dotdash-life-vs-health-insurance-choosing-what-buy-Final-b6741f4fd8a3479b81d969f9ea2c9bb3.jpg)

Life Vs Health Insurance Choosing What To Buy

2021 Ultimate Guide To Premium Financed Life Insurance Banking Truths

2021 Ultimate Guide To Premium Financed Life Insurance Banking Truths

2021 Ultimate Guide To Premium Financed Life Insurance Banking Truths

Are Life Insurance Premiums Tax Deductible In Canada

Infinite Banking Concept The Definitive Guide

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

Premium Financing An Option For Disappointed Life Insurance Policyholders

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

2021 Ultimate Guide To Premium Financed Life Insurance Banking Truths

2021 Ultimate Guide To Premium Financed Life Insurance Banking Truths

Life Insurance How To Choose The Perfect Policy 2022

How Does The Current U S Health Care Financing System Compare To A Well Designed Single Payer National Hea Health Programs Healthcare Costs National Health