million dollar life insurance policy payout

A life insurance policy that a company purchases on a key executives life. Fraud - If the deceased is found to have provided misleading information about their life risks when purchasing the policy such as hiding the fact they regularly take part in base parachute jumping life insurance benefits.

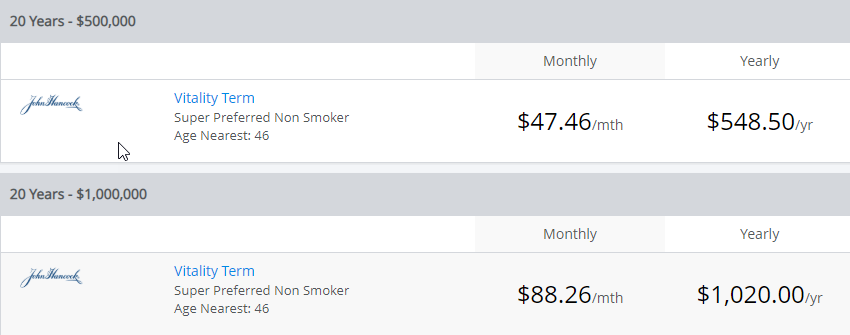

What Does A 5 10 Million Dollar Life Insurance Policy Cost In 2021

No matter the age of your life insurance policy in most cases your beneficiaries can claim a life insurance payout on a policy thats in force but theres a specific process theyll have to use.

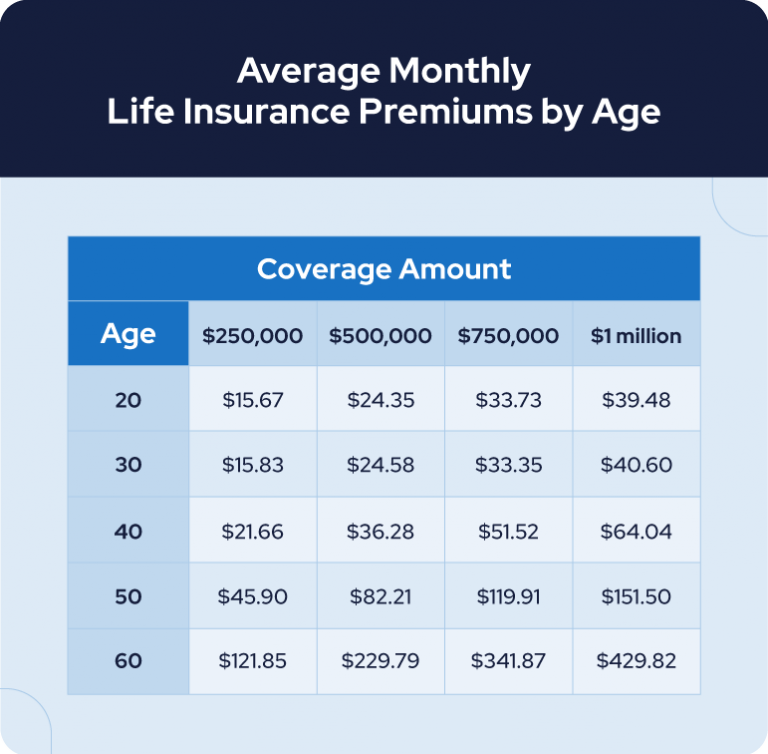

. Frequently Asked Questions Can I retire at 40 with 3 million. A 30-year-old man in excellent health can expect to pay 365 a year for a million-dollar policy according to Quotacy an online life insurance brokerage. Why Life Insurance Planning for Life Insurance.

The company is the beneficiary of the plan and pays the. At age 40 an immediate annuity will provide a guaranteed level income of 102621 annually for a life-only payout 102453 annually for a life with a 10-year period certain payout and 203613 annually for a life with a 20-year period certain payout. In the tables below well use an annuity with a lifetime income rider coupled with SSI to provide you a better idea of the income you could receive off 5 million dollars of retirement savings.

Million Dollar Life Insurance Who Needs Life Insurance Life Insurance Planning ABOUT LIFE. An insured has a life insurance policy from a participating company and receives quarterly dividends. It provides important life insurance and disability insurance protection as well.

Residents collected Social Security benefits in June 2020. The dividend option that the insured has chosen is called A. Vegas World was a space-themed casino and hotel on Las Vegas Boulevard in Las Vegas NevadaIt was owned and operated by Bob Stupak and was also signed as Bob Stupaks Vegas World.

Its not uncommon for individuals to be insured under a life insurance policy for 500000 to several million in death benefits. Stupak initially opened a small casino Bob Stupaks World Famous Million-Dollar Historic Gambling Museum and Casino on the property in 1974 but it was destroyed in a fire later that. Yes you can retire at 40 with three million dollars.

Its as simple as it sounds its a 1 Million death benefit payout to your family if you pass away unexpectedly. Key Person Insurance. For both benefits are either paid to the employer or directly to the employees families.

While older Americans make up about 4 in 5 beneficiaries another one-fifth of beneficiaries received Social Security Disability Insurance SSDI or were young survivors of. October 2016 Are You The Beneficiary of an AIG. 50000 to 15 million.

The payout will go to a secondary recipient or revert to the estate. The average monthly Social Security Income check-in 2021 is 1543 per person. Sa El is the Co-Founder of Simply Insurance and a.

This coverage can be used to help replace your income or to pay debts or cover other expenses. Youll owe the insurance company an annual dollar amount for your whole life insurance premium and a separate annual dollar amout for your PUA rider. Sometimes no additional medical underwriting is required making paid-up.

Now that you know why getting a 1 million dollar life insurance policy is important. Corporate Owned Life Insurance or COLI is life insurance on employees lives that is owned by any corporate employer not classified as a bank or credit union. How to Retire on 5 Million Dollars.

Over 64 million people or more than 1 in every 6 US. Best Guaranteed Coverage Ethos Our Partner. Once you add in the value of your home your retirement accounts.

BOLI is a life insurance policy purchased and owned by a bank on a group of executives. A whole life insurance policy is available for. Million Dollar Life Insurance Who Needs Life Insurance Life Insurance Planning ABOUT LIFE.

He has instructed the company to apply the policy dividends to increase the death benefit. It is possible to add a PUA rider to an existing policy but eligibility will depend on the insurance company your age and your health. How BOLI and COLI work.

Establishing such a policy means that Harbaugh will not need to repay the policy loan prior to his death at which point the coachs beneficiaries will get the remaining death benefit. The split-dollar agreement specifies that the University of Michigan will pay a total of 14 million in loan advances in seven payments of 2 million each into the life insurance policy.

Shopping For A 2 Million Term Life Policy 2022 Updated Rates

Whole Life Insurance Quotes Rates Policygenius

Term Life Vs Whole Life Insurance Understanding The Difference

Reliable Life Insurance Fort Worth Tx Get In Touch With Insurance Experts Best Life Insurance Companies Health Insurance Companies Life Insurance Companies

Life Insurance Over 70 How To Find The Right Coverage

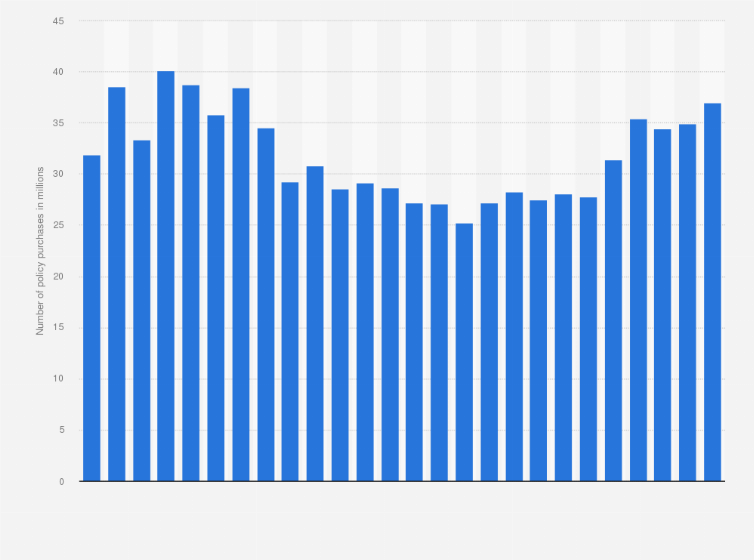

Number Of U S Life Insurance Policies Purchased 2018 Statista

What Is Whole Life Insurance Cost Types Faqs

How To File A Life Insurance Claim Legal General America

Truth About The Million Dollar Life Insurance Policy With Rates Pinnaclequote

Can A Nursing Home Take Your Life Insurance

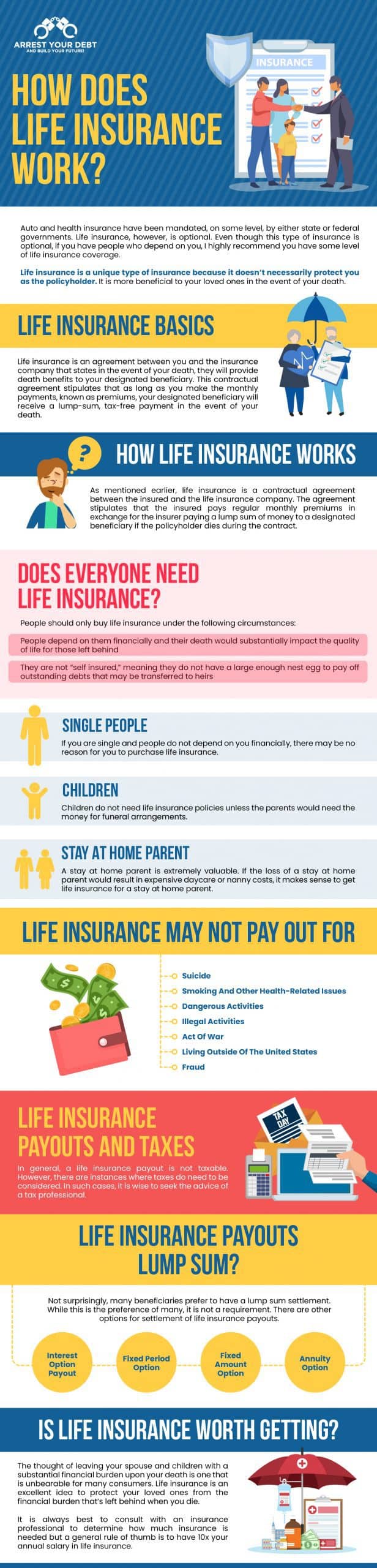

How Does Life Insurance Work Complete Guide Arrest Your Debt

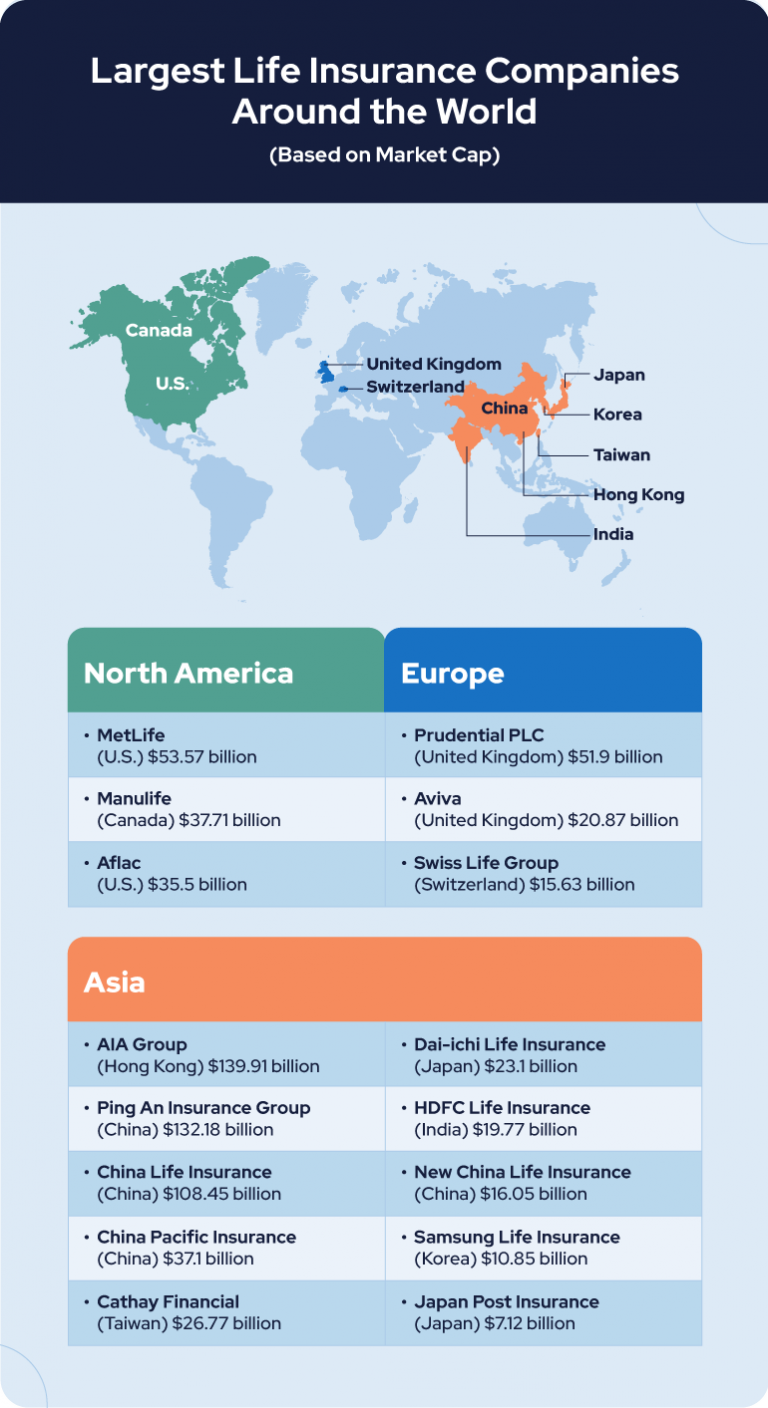

Facts About Life Insurance Must Know Statistics In 2022 Retireguide

Facts About Life Insurance Must Know Statistics In 2022 Retireguide

What Does A 5 10 Million Dollar Life Insurance Policy Cost In 2021

Million Dollar Life Insurance Policy Find An Agent Trusted Choice

Pin On Life Insurance For Seniors Quotes

Facts About Life Insurance Must Know Statistics In 2022 Retireguide

How Much Does Million Dollar Life Insurance Cost Who Needs It

How Life Insurance Works Your Guide To Understanding Life Insurance